Worried About Your Financial Plan? Schedule A Q&A Call Today

To say the coronavirus pandemic has taken the world by storm wouldn’t do justice to the severity of the situation. If it was just our health that was affected, that’s one thing. But unfortunately, we’re having to balance the negative effects of this widespread virus with job loss, reduced working hours, and decreased portfolio balances. There’s plenty to worry about, but we believe there is one thing that should not be causing you stress, and that’s your financial plan.

A Plan To Avoid Worry

The purpose of having a financial plan is so that you can experience confidence and be ready when chaos comes. Taking the intentional steps of examining your life situation, identifying your goals, and mapping out the path to achieve them brings peace of mind and gives you a financial future to look forward to.

If you aren’t sure if your plan is set up to withstand our current economic circumstances or you are wondering if you need to make any changes to weather this storm better, we are here to help you thrive.

What Does A Financial Plan Include?

First, you may be wondering about what goes into a comprehensive plan. Financial plans often address a myriad of concerns and goals, from college planning to retirement income strategizing. Depending on your needs, your plan may narrow in on one element or address multiple goals you’d like to achieve over time. Whatever you choose to focus on, your financial plan is designed to serve as your road map, helping you navigate the years before, during, and after your transition to retirement.

We believe a good financial plan should give you a detailed, complete view of your current financial situation, a thorough modeling of where you want to be, and the actions you need to take to reach those goals. It should address all the pieces of your financial puzzle, from stresses and fears to your values and dreams, and include risk factors, cash flow, retirement, estate planning, taxes, education, and income strategies to help bring you clarity and guidance. It is through our planning process that we can help you prepare for life’s expected and unexpected circumstances.

The result is a simple yet powerful road map to guide you toward financial freedom.

See A Sample Financial Plan

Here is a sample financial plan that reflects our planning process. It looks at a fictional client’s lifestyle income plan and how we developed it, including identifying their goals, creating a balance sheet, reviewing their cash flow, and more.

Keep in mind that this is only a hypothetical plan presented to illustrate what a client’s plan may resemble should they work with me. The characters and circumstances are completely fictional and are for illustrative purposes only. Be sure to seek the advice of a qualified professional for your particular situation and not rely upon any of the information herein to make personal financial decisions.

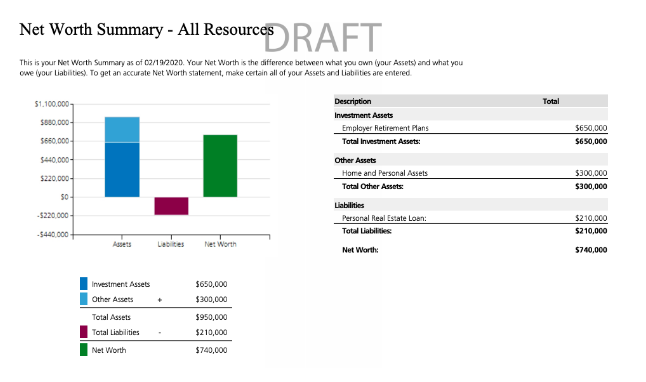

First, we provide an overview of your current situation. With just one glance, you can see a big picture of your financial life, including assets broken down into specific categories and short-term and long-term liabilities.

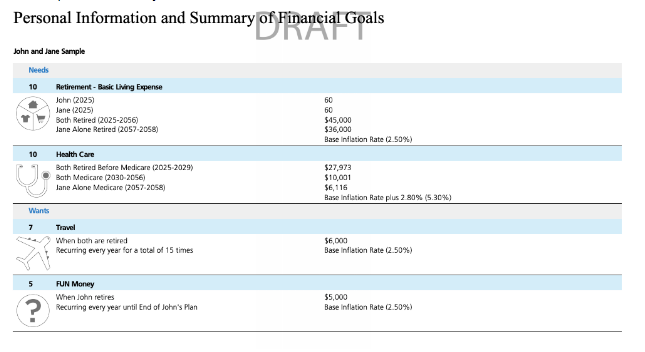

Our financial planning is goals-based. This means we help you develop specific budgets for your future goals and needs—pre and post retirement. This approach allows us to more accurately predict your future spending needs and accommodate for how those needs will change over time. Our advanced planning software allows us to bring all these things together in a comprehensive way that makes sense.

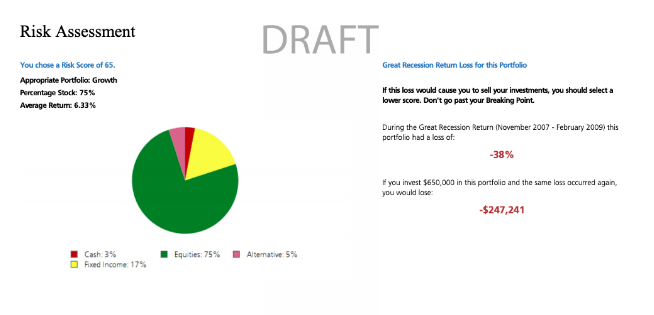

Because we want your money to last as long as you do, we run a comprehensive risk assessment to determine how to allocate your money to both help protect your assets and achieve the growth you need to reach your goals.

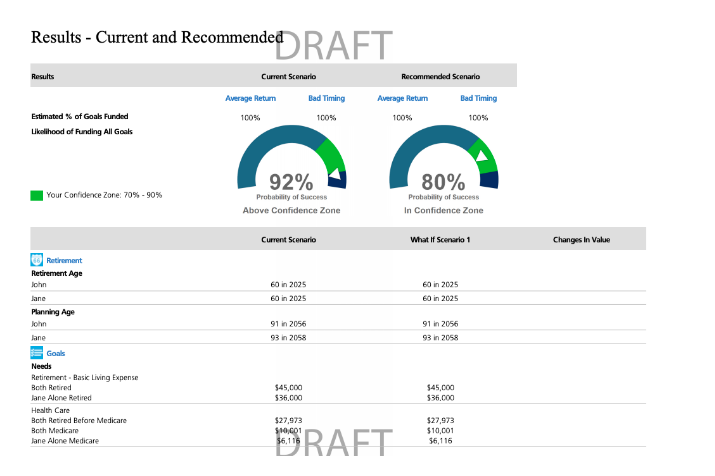

Because the future is uncertain, we use a Monte Carlo simulation to test your financial plan. A Monte Carlo simulation runs 1,000 hypothetical simulations of your plan using different, randomized stock market outcomes to determine the probability of success for your plan. We run an initial test based on your current scenario and then collaborate with you to tweak different variables—like retirement age, Social Security strategy, goal spending and savings amounts, among others—to come up with a plan that has a high probability of success and feels good to you.

In addition to a detailed study of each of your goals and a clearly mapped-out plan to help get you there, we also create a risk management plan to cover your bases and give you increased confidence. The end result? An actionable implementation list and a road map for your future.

The projections or other information generated by Monte Carlo analysis tools regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary with each use and over time.

Get Started On Your Plan!

We know that life—and your finances—probably look very different right now. Our team at Bridgerland Financial is here to guide you during this stressful time. In fact, you are our number-one priority right now.

We would love to answer your questions and address your concerns about your money, your goals, asset allocation, risk, what the markets are doing, or anything that’s causing you financial worry. Schedule an appointment online or reach out to us at david.packer@bridgetoretire.com or (435) 535-1630 to experience the difference a customized financial plan can make!

About David

David Packer is founder and financial advisor at Bridgerland Financial, an independently managed financial firm in Utah. With 20 years of industry experience, David serves his clients by helping them bridge the gap between their working years and their retirement. He provides tailored, comprehensive financial plans to his business owner and individual clients so they can retire with confidence. David has a bachelor’s degree in finance and holds the Chartered Retirement Planning Counselor℠ (CRPC®) credential. Outside of the office, David loves to spend time with his wife and five kids and stay involved in his community. He currently serves on the board of directors of the Cache Valley Chamber of Commerce. He and his wife, Melonie, spent years as foster parents and eventually adopted their foster children. David loves playing and watching all kinds of sports, including officiating high school sports, and won’t turn down a good board or card game. Learn more about David by connecting with him on LinkedIn.